Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, has warned that roughly half of low-income countries are either in or nearing debt distress, calling for urgent interventions. While Nigeria is officially classified as a lower-middle-income country by the World Bank for 2024–2026, the nation’s public debt has surged since 2023, reaching an estimated $100 billion, with the debt service-to-revenue ratio projected at 47 percent in 2025.

Speaking at the ongoing Technical Group Meeting of the Group of 24 Nations (G-24) in Abuja, Edun noted that debt servicing has become a significant burden for many countries in the Global South. He emphasised that annual debt payments in these nations now exceed inflows from Overseas Development Assistance and Foreign Direct Investment from the Global North. “This gathering is an opportunity to reshape the development trajectory of the Global South at a time when global risks are converging faster than institutions can respond,” he stated. Edun further noted that about 25 percent of Emerging and Developing Economies (EMDEs) have lost access to international capital markets, making reliance on internally generated revenue more critical than ever.

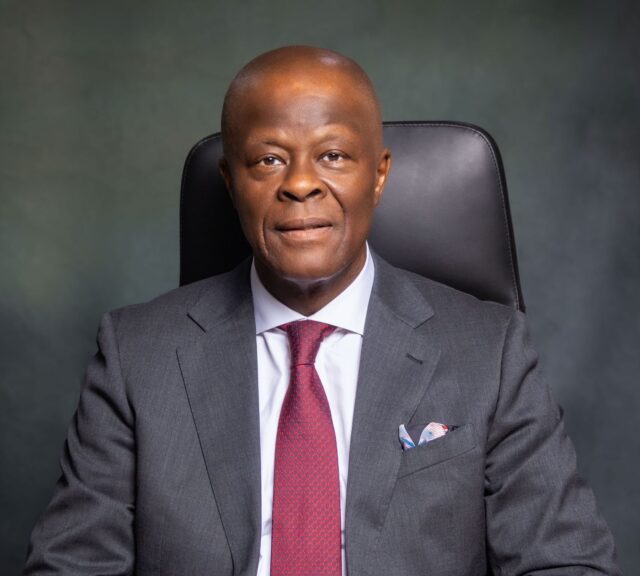

Also addressing the meeting, the Governor of the Central Bank of Nigeria (CBN), Mr. Olayemi Cardoso, described cross-border payments among G-24 countries as slow, costly, and fragmented. He highlighted that global remittance corridors often carry costs above 6 percent, with settlement delays and compliance barriers excluding micro, small, and medium enterprises (MSMEs) from global opportunities. Cardoso called for urgent adoption of digital solutions to make cross-border payments faster, cheaper, and more inclusive.

Cardoso said his keynote on “Digital Cross-Border Payments, Global Finance, and Economic Transformation – Opportunities and Risks” was not merely technical but a fundamental development priority for G-24 nations. He commended Edun, G-24 Chairman, for championing a vision that modernises global finance, strengthens domestic capacities, and ensures digital transitions drive shared prosperity. “These priorities align closely with the mandate of central banks across G-24 countries,” he added.

He emphasised that efficient cross-border payment systems are essential for international financial stability. “For G-24 economies, inefficiencies translate into higher remittance costs, expensive FX transactions, fragmented settlements, and barriers to MSME participation in global trade. Improving these systems is not just a technical reform—it is a macroeconomic and development imperative,” Cardoso concluded.